How Much Are In Cars In Ohio . How much is the car sales tax in ohio? When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. In addition to this, you must also pay the county or local sales tax in your home county. In addition to the state sales tax on. This tax law applies to all ohio car sales, including used cars. It's important to note, this does not. State sales tax rate in ohio: Calculating ohio car tax is important, whether you are in the market for a new or used car. Whether you purchase from a. While this number seems high, used. The sales tax rate for cars is 5.75%, which applies to all car sales in the state. 50 rows by julie blackley. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. The current sales tax on car sales in ohio is 5.75%.

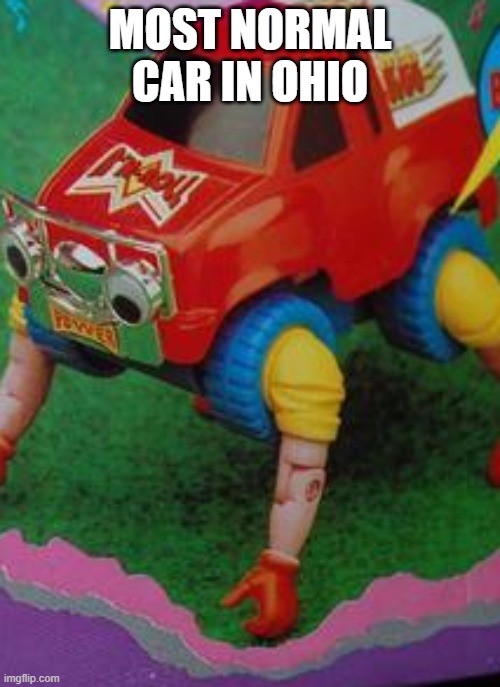

from imgflip.com

State sales tax rate in ohio: Calculating ohio car tax is important, whether you are in the market for a new or used car. It's important to note, this does not. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. While this number seems high, used. Whether you purchase from a. In addition to this, you must also pay the county or local sales tax in your home county. How much is the car sales tax in ohio? This tax law applies to all ohio car sales, including used cars. 50 rows by julie blackley.

cars in ohio Imgflip

How Much Are In Cars In Ohio State sales tax rate in ohio: The sales tax rate for cars is 5.75%, which applies to all car sales in the state. In addition to the state sales tax on. How much is the car sales tax in ohio? In addition to this, you must also pay the county or local sales tax in your home county. While this number seems high, used. 50 rows by julie blackley. When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. It's important to note, this does not. Calculating ohio car tax is important, whether you are in the market for a new or used car. State sales tax rate in ohio: The current sales tax on car sales in ohio is 5.75%. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. Whether you purchase from a. This tax law applies to all ohio car sales, including used cars.

From imgflip.com

Imgflip How Much Are In Cars In Ohio In addition to the state sales tax on. State sales tax rate in ohio: When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. 50 rows by julie blackley. According to the sales tax handbook, you pay a minimum of 5.75 percent sales. How Much Are In Cars In Ohio.

From www.youtube.com

Ohio Classic cars 7 YouTube How Much Are In Cars In Ohio While this number seems high, used. The current sales tax on car sales in ohio is 5.75%. 50 rows by julie blackley. This tax law applies to all ohio car sales, including used cars. Calculating ohio car tax is important, whether you are in the market for a new or used car. When buying a car in ohio, you’ll pay. How Much Are In Cars In Ohio.

From cashforyourjunkcar.org

How To Junk A Car In Ohio • Cash For Your Junk Car How Much Are In Cars In Ohio In addition to the state sales tax on. It's important to note, this does not. Calculating ohio car tax is important, whether you are in the market for a new or used car. How much is the car sales tax in ohio? The sales tax rate for cars is 5.75%, which applies to all car sales in the state. Whether. How Much Are In Cars In Ohio.

From autosdonation.com

How To Donate A Car In Ohio? How Much Are In Cars In Ohio In addition to this, you must also pay the county or local sales tax in your home county. This tax law applies to all ohio car sales, including used cars. Calculating ohio car tax is important, whether you are in the market for a new or used car. 50 rows by julie blackley. According to the sales tax handbook, you. How Much Are In Cars In Ohio.

From www.damagedcars.com

Ohio Motor Car Title How to transfer a vehicle, rebuilt or lost titles. How Much Are In Cars In Ohio While this number seems high, used. In addition to this, you must also pay the county or local sales tax in your home county. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. Whether you purchase from a. Calculating ohio car tax is important,. How Much Are In Cars In Ohio.

From webuycarstoledo.com

Scrap My Car in Ohio (419) 2739676 How Much Are In Cars In Ohio In addition to this, you must also pay the county or local sales tax in your home county. While this number seems high, used. Whether you purchase from a. The sales tax rate for cars is 5.75%, which applies to all car sales in the state. According to the sales tax handbook, you pay a minimum of 5.75 percent sales. How Much Are In Cars In Ohio.

From altdriver.com

Goodguys Show Displays Thousands of Classic Cars in Ohio alt_driver How Much Are In Cars In Ohio State sales tax rate in ohio: According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. This tax law applies to all ohio car sales, including used cars. In addition to the state sales tax on. 50 rows by julie blackley. While this number seems. How Much Are In Cars In Ohio.

From drivingdc.com

BestSelling Cars in The State of Ohio Driving DC How Much Are In Cars In Ohio Calculating ohio car tax is important, whether you are in the market for a new or used car. State sales tax rate in ohio: It's important to note, this does not. When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. 50 rows. How Much Are In Cars In Ohio.

From autoauctionsohio.com

Used Cars for Sale Under 3000 At Ohio Auto Auctions How Much Are In Cars In Ohio Whether you purchase from a. State sales tax rate in ohio: When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. This tax law applies to all ohio car sales, including used cars. How much is the car sales tax in ohio? While. How Much Are In Cars In Ohio.

From www.cardonationwizard.com

Ohio Title Transfer Donate a car in OH on Car Donation Wizard How Much Are In Cars In Ohio According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. How much is the car sales tax in ohio? It's important to note, this does not. Whether you purchase from a. State sales tax rate in ohio: This tax law applies to all ohio car. How Much Are In Cars In Ohio.

From carbrain.com

How to Transfer a Car Title in Ohio. Sell My Car in Ohio Fast How Much Are In Cars In Ohio State sales tax rate in ohio: According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. Calculating ohio car tax is important, whether you are in the market for a new or used car. 50 rows by julie blackley. The sales tax rate for cars. How Much Are In Cars In Ohio.

From www.youtube.com

most normal car in Ohio ohio meme funny YouTube How Much Are In Cars In Ohio Whether you purchase from a. While this number seems high, used. The current sales tax on car sales in ohio is 5.75%. In addition to the state sales tax on. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. Calculating ohio car tax is. How Much Are In Cars In Ohio.

From africacheck.org

No, photo does not show accident between the ‘only two cars’ in the US How Much Are In Cars In Ohio 50 rows by julie blackley. Calculating ohio car tax is important, whether you are in the market for a new or used car. In addition to this, you must also pay the county or local sales tax in your home county. How much is the car sales tax in ohio? This tax law applies to all ohio car sales, including. How Much Are In Cars In Ohio.

From www.reddit.com

The first two cars in Ohio r/technicallythetruth How Much Are In Cars In Ohio The sales tax rate for cars is 5.75%, which applies to all car sales in the state. In addition to the state sales tax on. 50 rows by julie blackley. When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. How much is. How Much Are In Cars In Ohio.

From imgflip.com

cars in ohio Imgflip How Much Are In Cars In Ohio In addition to this, you must also pay the county or local sales tax in your home county. When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from a private seller or a. While this number seems high, used. How much is the car sales tax in ohio?. How Much Are In Cars In Ohio.

From memes.com

Average car ride in Ohio. Cursedmemes69 Memes How Much Are In Cars In Ohio In addition to the state sales tax on. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. Whether you purchase from a. When buying a car in ohio, you’ll pay 5.75% (plus applicable local tax) of the vehicle’s purchase price, whether you buy from. How Much Are In Cars In Ohio.

From www.youtube.com

Top 5 Ohio cars ☠ YouTube How Much Are In Cars In Ohio 50 rows by julie blackley. This tax law applies to all ohio car sales, including used cars. While this number seems high, used. The sales tax rate for cars is 5.75%, which applies to all car sales in the state. Whether you purchase from a. It's important to note, this does not. State sales tax rate in ohio: Calculating ohio. How Much Are In Cars In Ohio.

From www.youtube.com

Best Classic Car Show in Ohio YouTube How Much Are In Cars In Ohio Calculating ohio car tax is important, whether you are in the market for a new or used car. How much is the car sales tax in ohio? According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of. It's important to note, this does not. The. How Much Are In Cars In Ohio.